Simplicity and Security: Advantages of using Fluid Protocol

What makes a DeFi Protocol "Robust"?

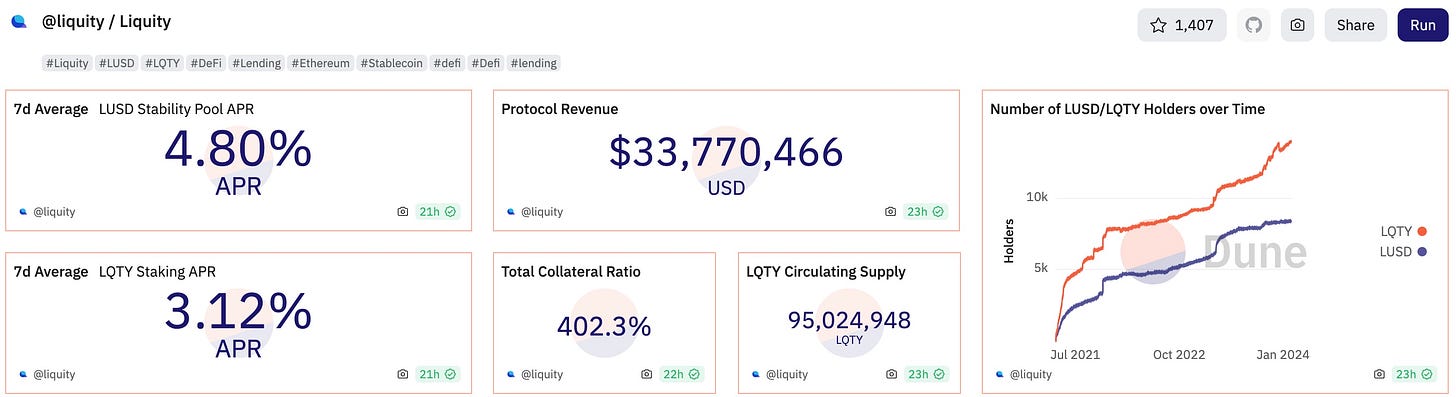

Discovering a DeFi protocol from 2020 that not only thrives today but also boasts over $600M in Total Value Locked (TVL) without a history of hacks or exploits is a daunting task. Pushing the challenge further to find one that embodies true immutability and decentralization narrows the field significantly—UniSwap included.

Liquity stands out in this elite category, exemplifying resilience, security, and unwavering commitment to decentralization. Building upon Liquity's principles, Fluid Protocol is set to launch on Fuel. This integration aims to boost transaction efficiency and ensure scalability for users, all while leveraging Ethereum's secure foundation. By doing so, Fluid Protocol aspires to improve DeFi infrastructure, offering greater sustainability and accessibility.

How is Liquity so based?

Liquity's robust design largely stems from its reliance on Ethereum as the sole collateral type. This strategy leverages Ethereum's prominent status as the most extensively researched and dynamic cryptocurrency, surpassing even Bitcoin in these aspects. The use of Ethereum to overcollateralize its stablecoin, $LUSD, ensures a stable peg, underpinned by Ethereum's resilience against crashing to zero barring extraordinary events. This acutefocus on Ethereum provides a solid foundation for $LUSD's stability and the protocol's overall reliability.

At Fluid Protocol, the cornerstone of our work is centered on supporting the highest quality of collateral types. Reflecting on DeFi’s proliferation and adoption, with its experiments, mistakes, and volatility, it's clear that the path forward is one of discernment. Learning from the past, especially the pitfalls of relying on token derivatives, valueless tokens, and governance tokens for liquidity, Fluid Protocol is adopting a quality over quantity approach in selecting collateral types, aiming for stability and reliability in its offerings. Note that collateral types have not yet been officially announced, other than $ETH & $stETH.

Just like Liquity's strength is anchored in Ethereum (ETH), having faith in the underlying assets behind USDF—the native stablecoin of the Fuel Network—is key to a widely used DeFi protocol. Fluid is designed with a governance-free approach, symbolizing a system that's as reliable and straightforward as a IF this THEN that function: input the correct amount, and the expected output follows. The selection of oracles, vital for accurate price feeds and triggering partial liquidations, is approached with a commitment to quality, and we’ll announce our first integration soon.

Fluid Protocol at a Glance

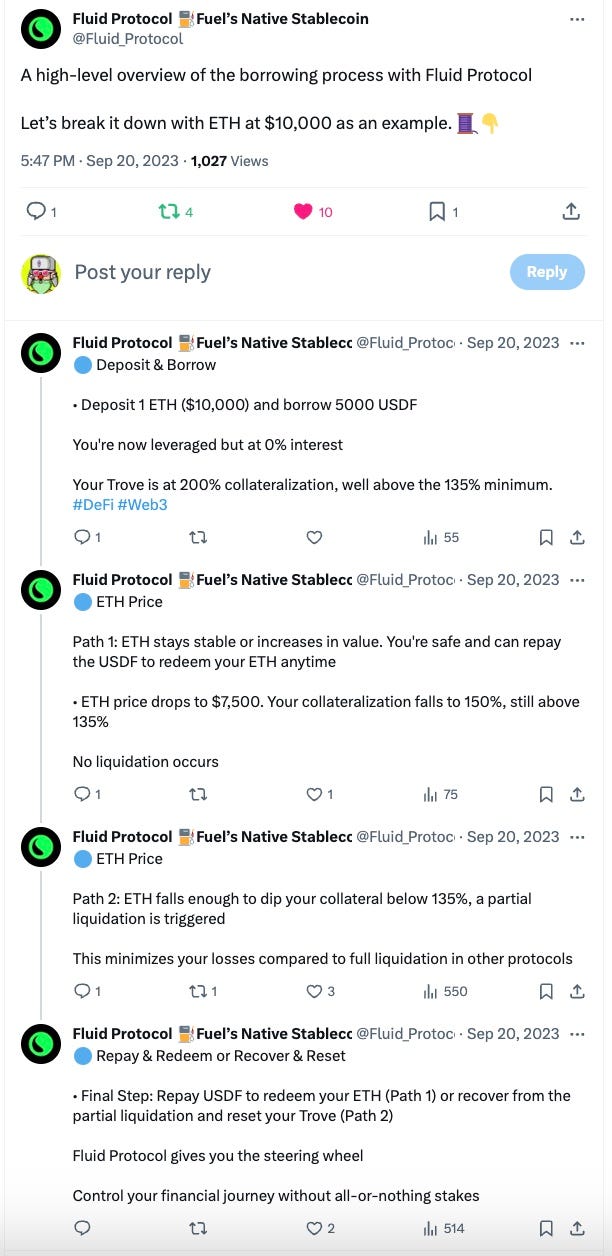

It’s best to understand Fluid Protocol's simplicity and security through a practical example. Imagine a user optimistic about Ethereum's future, aiming to leverage their ETH for liquidity without losing exposure to its potential appreciation. They deposit 1 ETH, valued at $10,000, to borrow 5,000 USDF. This action leverages their position at zero interest, securing a collateralization ratio of 200%, well above the 135% minimum. With no interest or repayment deadline, and minimal fees, the user enjoys complete freedom over the 5,000 USDF. This is the essence of DeFi, where users are always in control and responsible for their assets, safeguarded by smart contracts that interact exclusively with the user's private keys.

Fluid Protocol has been rigorously vetted by third-party audits from reputable firms, ensuring a peer reviewed approach. While users may encounter more complex scenarios than the example above, every interaction within the protocol is transparent and trackable on-chain. Comprehensive documentation is available, detailing the protocol's parameters to ensure clarity and understanding for all users. This commitment to transparency and security underpins the protocol's reliability. Lastly, our team is approachable and here to serve you, the community, as best we can.

Our goal is to create a durable DeFi infrastructure to support the expansive Web3 community sustainably, mirroring Liquity's successful model. This foundation aims to be a cornerstone for future developments, facilitating growth and innovation across the ecosystem for years ahead. Our docs outline our approach to progressive decentralization, which we will work towards as we closely monitor the protocol and Fuel ecosystem upon launch.

In Conclusion

Liquity is a highly underrated piece of Web3 infrastructure whose lindy-ness cannot be denied. It’s framework is the inspiration behind Fluid Protocol which will introduce USDF, the native stablecoin of Fuel. USDF's resilience and stability through the robust framework of Fluid Protocol will make it an attractive collateral choice for DeFi services seeking diversity beyond centralized tokens like USDC, USDT, or DAI. Incorporating USDF into collateral options or trading pairs allows these services to minimize reliance on centralized and potentially censorable assets, enhancing the robustness and independence of their offerings.

Join the Fluid Protocol Mission

Building upon the established credibility of Liquity, Fluid Protocol is gearing up for the highly anticipated Fuel Mainnet launch. We eagerly await the formation of new partnerships, collaborations, and integrations that will propel both Fluid and Fuel Network to new heights within the DeFi sphere.

We invite you to join Fluid’s Discord community to stay informed about the latest advancements and become an integral part of this remarkable journey. Let's delve into the new era of DeFi and unveil the myriad of opportunities that Fluid Protocol and Fuel Network have in store.